In Quickbooks you'll have to enter each payment separately. First create the payment from the Pay Bills screen for the check. After you select the bill you are paying you can change the Amount To Pay column to reflect how much the check is for. Either print the check, or assign the check number if you have already written it. Then repeat the process if your Petty Cash is set up in the Chart of Accounts as a "Bank" account, and choose the the PC bank account for your payment method.

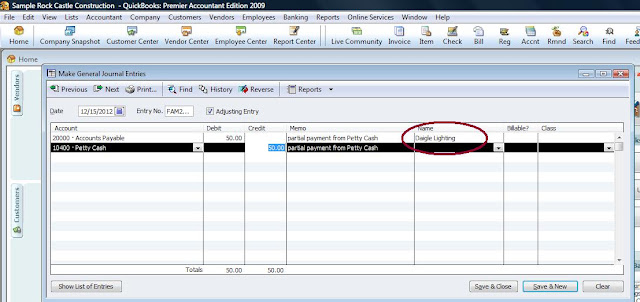

Or use a journal entry to debit Accounts Payable (attach this debit to the Vendor name) and credit Petty Cash for the amount of the payment. Once you do this journal entry you will have an available credit to apply to the bill in the Pay Bills window.

Return to the Pay bills window, select the bill you are applying the payment to and you will see an amount equal to the Petty Cash payment in the Available Credit section of the Pay Bills window. You will not the this amount until you have actually marked the Bill to pay.

Then simply select the Set Credits button and you can apply the payment in the Apply Credits window. If there is only one credit available to use, Quickbooks will select it automatically, then check Done.

You will be returned to the Pay Bills window. Choose Pay Selected Bills then Done in the Payment Summary window.

This material is for informational

purposes only and not intended and financial, legal or tax advice.

Please consult your finance, legal or tax professional to confirm the

accuracy of all information. Quickbooks is a registered product of

Intuit.

Email your question

Bookkeeping is a very importing part in the running of a any business and should not be taken lightly.

ReplyDeletebook keeper melbourne