Should all the donations go in the same "Donations" income account? Or should we do "Individual Donations" and "Church Donations" accounts? Should we do a sub account for designated funds, or leave those funds in their separate accounts as they are currently? Or should we set up the building fund, scholarships, etc, as classes within the individual donations account? We would be needing the easiest way to see the total amount of funds received.

A. Your un-designated funds would be the General Fund Account. Each donor does not need their own income account, nor does the donor type need it's own account because you will be able to generate future reports for any income account, and limit them to a Donor (Church, individual, etc) name and or/ by Donor type, which you have already created.

Your income accounts might look like this...

Camp Income

General Donations

I recommend creating the restricted funds income accounts using the "Other Income" account type. Such as...

Building Donations

Scholarship Donations

This way they will still appear on your annual P&L but will appear separately from general income & expenses at the bottom of the report.

Create expense accounts for the restricted funds as well. You can also create sub accounts for more detail. For example, you might create Architect, Permits & Plans, Build-out, etc. as sub accounts under a Building Project expense account. Create these using the "Other Expense" account type so that these expenses will appear at the lower part of the report along with the restricted income.

You also want to create liability accounts for items like the Building Fund and Scholarship Fund, etc.

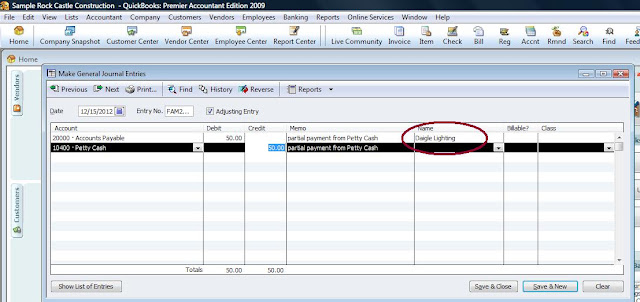

At the end of the fiscal year the income total for the year will need to be moved out of Retained Earnings and into these restricted liability accounts with a single journal entry. Create these accounts as "Equity" type accounts.

Under these Equity accounts create sub-accounts called "Funds Distributed". This is where you will move the expense total for the year out of retained earnings, again using a journal entry.

This will allow the balance of the restricted funds to appear on your balance sheet in the equity section. Recording transactions in the income and expense accounts first will also allow you to pull detailed reports of the income and expenses at any given point later on.

This

material is for informational

purposes only and not intended and financial, legal or tax advice.

Please consult your finance, legal or tax professional to confirm the

accuracy of all information. Quickbooks is a registered product of

Intuit.

Email your question