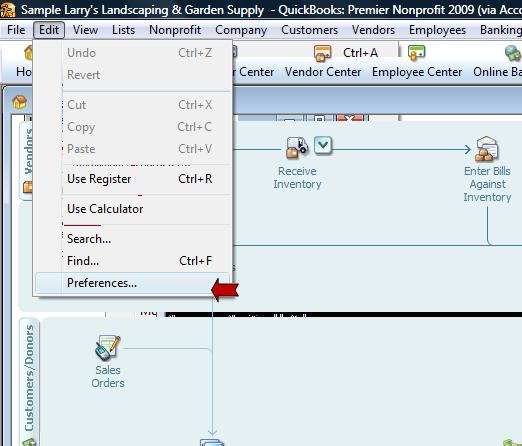

Chose "Edit" on the top menu bar of Quickbooks, and "Preferences".

Then chose "Sales Tax" from the preference list and click on the Company Preferences tab.

Click on the "No" box and all sales tax options will be grayed out, then click "OK". Quickbooks will prompt you that it will close all other screens that my be open in order to make this change.

Once this change is complete you will not longer see a sales tax box at the bottom of your customer forms.

If you have a sales tax license, please check with your accountant and local revenue department to see if in fact you may, on occasion, be required to remit sales tax. If that is the case, do not make this change.

This material is for informational

purposes only and not intended and financial, legal or tax advice.

Please consult your finance, legal or tax professional to confirm the

accuracy of all information. Quickbooks is a registered product of

Intuit.

No comments:

Post a Comment